FY2022 Financial Highlights

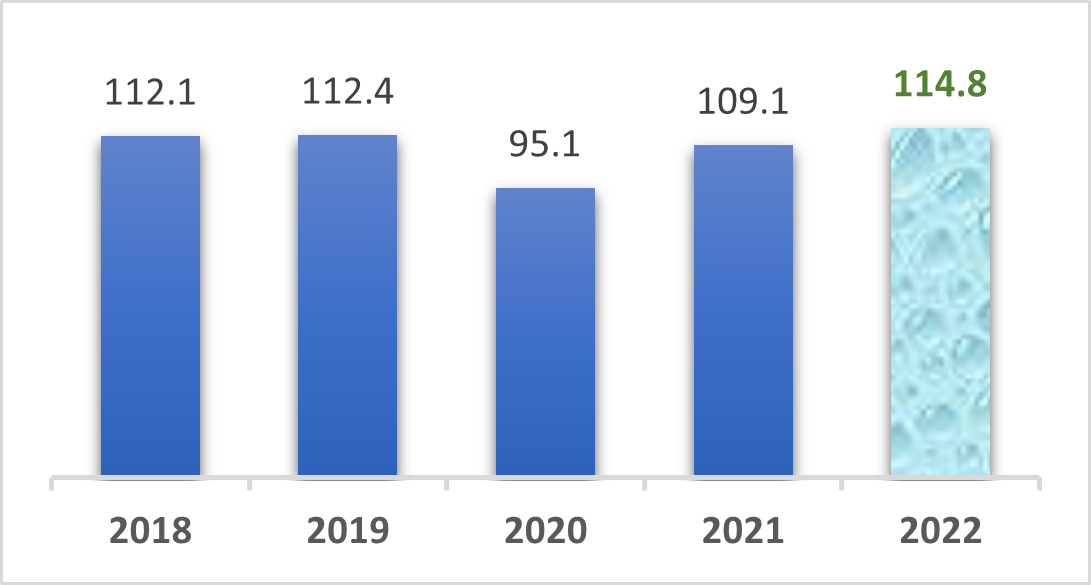

Revenue £m

£114.8m

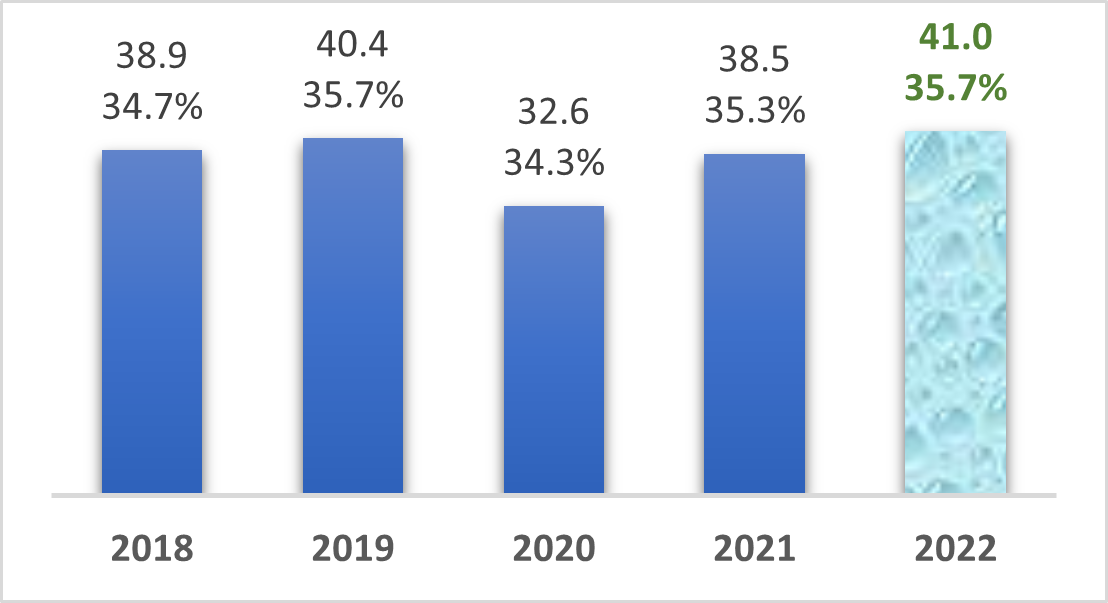

Gross Profit £m / %

£41.0m

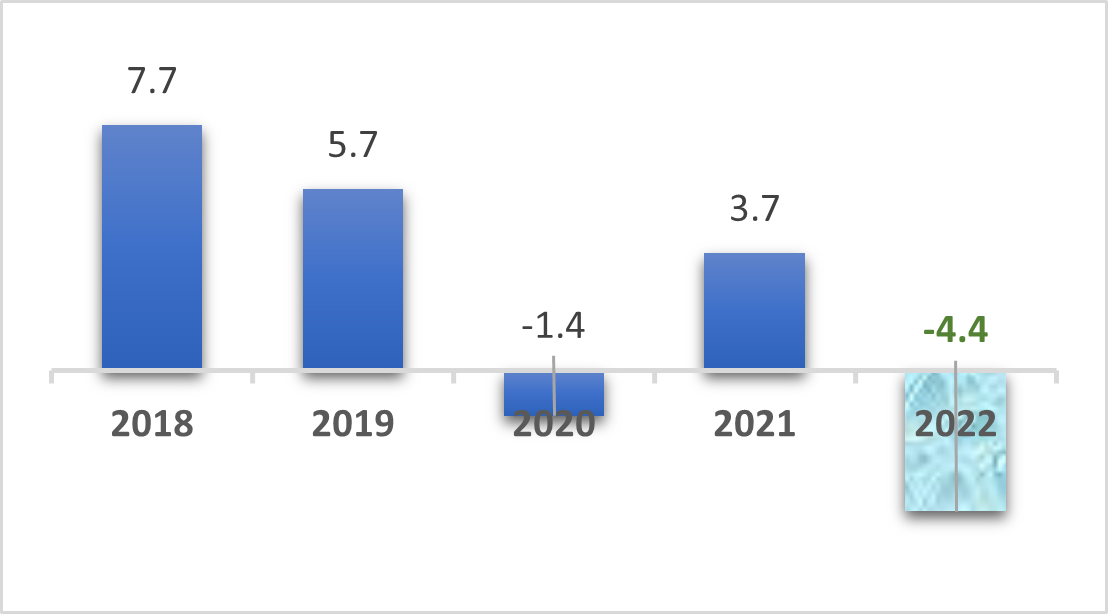

Operating profit/(loss) £m

-4.4%

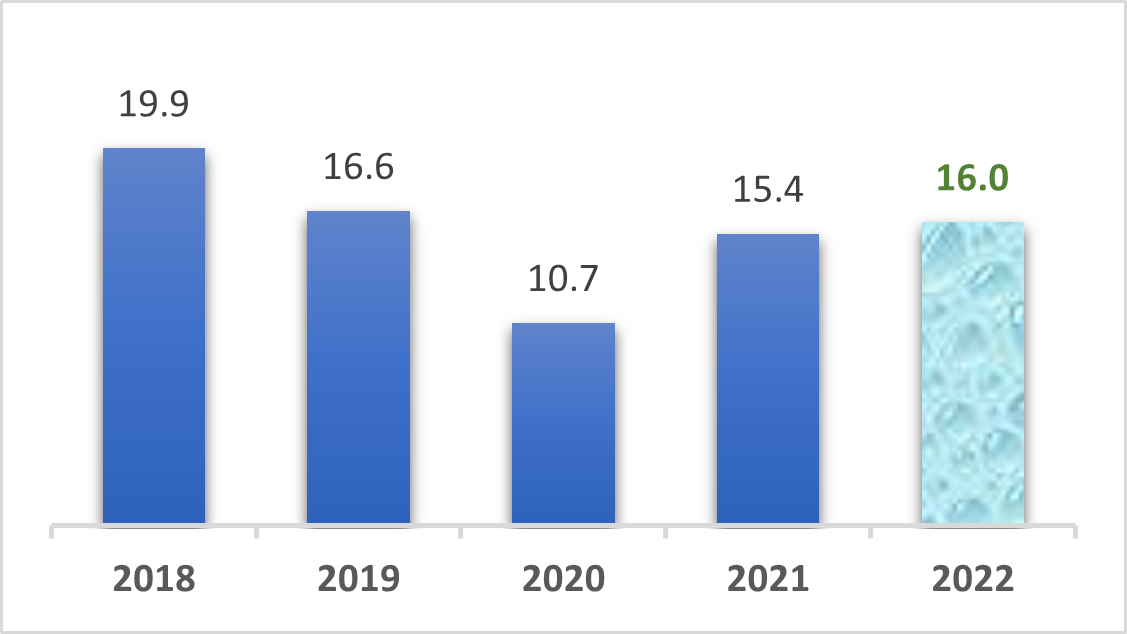

Net debt (*) £m

£(16)m

*Net Debt is Bank Debt less cash and cash equivalents. It excludes lease liabilities under IFRS 16. 2020 includes HMRC support

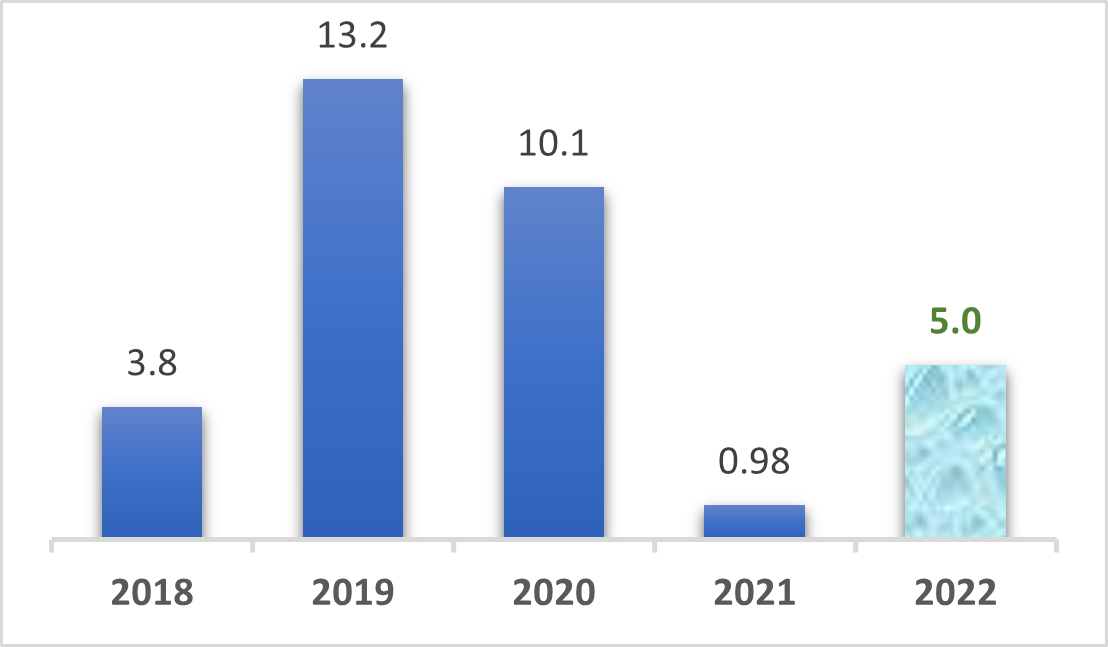

Net cash from operating activities £m

£5.0m

(*) FY 2020 cash flow restated for £1,418k VAT for Q1 2020 deferred and paid in FY 2021 to reflect normalised net cash from operating activity

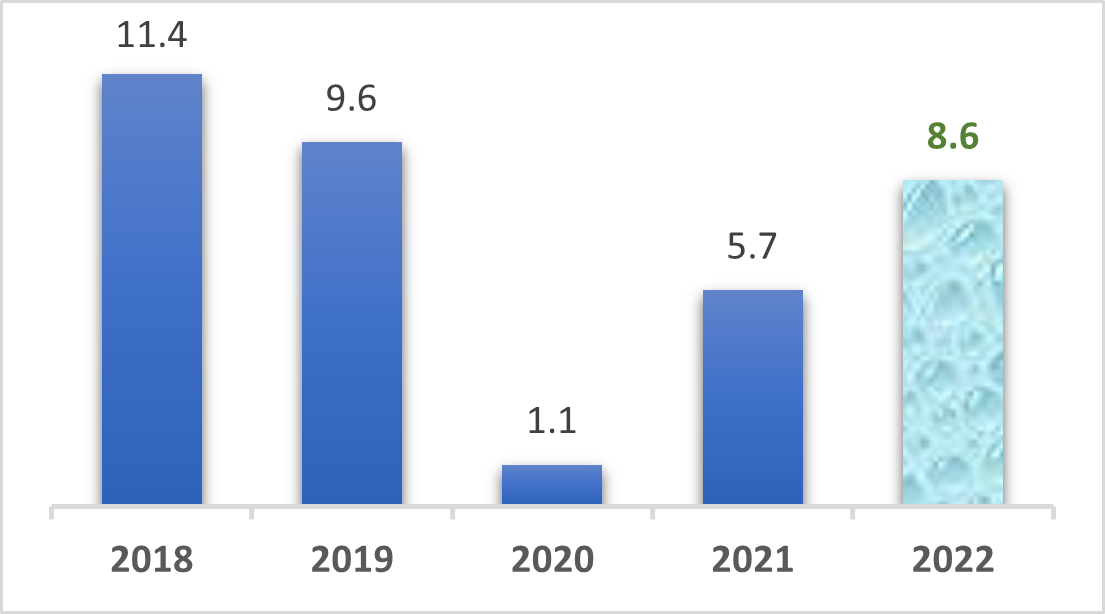

Underlying operating profit £m

£8.6m

FY2022 Financial & Operational Highlights

Revenue of £114.8m (2021: £109.1m), £5.7m (5.2%) up on 2021

- £8.6m underlying operating profit* (2021: £5.7m), an improvement of £2.9m as the business continued its recovery from the COVID-19 pandemic

- £11.6m underlying EBITDA⁺(2021: £8.4m), an improvement of £3.2m

- Measures taken to manage the cost base, in particular a significant reduction in headcount by the end of the year, has reduced underlying operating overheads** by £0.4m (1.3%) in an environment of significant inflationary pressures

- Significantly improved performance by the Services segment with underlying operating profit of £1.8m (2021: -£0.1m)

- Managed inventory levels (£1.0m increase in 2022) to mitigate the impact of supply chain uncertainties and satisfy customer demand for core products. Now reducing (£3.2m decrease in H2 2022) with more predictable supply chains

- After taking account of the separately disclosed items the loss before tax was £5.6m

- Looking forward to 2023 being a year of further improvements, with particular focus on inventory management, and cash generation

(*) Underlying operating profit is used as an alternative performance measure to assess the trading performance of the business and is operating profit before separately disclosed items which are amortisation and impairment of acquired intangibles, impairment of goodwill, share based payments, and restructuring costs.

(+) Underlying EBITDA is underlying operating profit prior to depreciation charges and website amortisation.

(**) Underlying operating overheads is the total of distribution costs and administrative expenses before separately disclosed items.